Tamil Nadu Finance Minister PTR Palanivel Thiaga Rajan who has been a vocal critic of the GST system and held the view that the system is ‘inherently regressive and overly Centralised’, has called for a new social pact between the Union and States in terms of distribution of fiscal powers.

In his written speech for the 45th GST Council meeting, chaired by Union Finance Minister Nirmala Sitharaman in Lucknow on September 18, he said the Tamil Nadu government has proposed to establish a council of eminent Economists, legal luminaries and scholars to help “refine our understanding and positions regarding the social pact between Union and the States in terms of distribution of fiscal powers.”

Faulting the GST taxation model, he stressed the state’s stand that there need be a fundamental rethinking of the entire model of taxation and complete overhaul of both direct and indirect taxes.

Mr Thiaga Rajan who could not attend the meeting, the first physical meeting held after more than a year in view of the Covid-19 pandemic, went through 500- odd pages of the meeting’s agenda and answered each agenda in detail, setting forth the views of Chief Minister M.K Stalin at the meeting.

Pointing out that States have given up substantial fiscal autonomy, both in terms of volume and control, while reluctantly acquiescing to implement the GST system, Mr Rajan said with four years of experience under the GST regime, this was an opportune time to review the costs and benefits of introducing GST from the States’ perspective.

“The promise of higher GDP growth due to introduction of GST and consequent growth in taxation revenues have remained elusive, even factoring out the overall devastation of the COVID pandemic,” he said. The negative consequences have been mitigated to some extent through the compensation mechanism written into the law, but “we must remember that this mechanism was only designed to address idiosyncratic risk (one or more states suffer negative events/outcomes, independent of the country’s economy as a whole), and had no provision or feature to cope with systemic risk (of the kind the country’s economy as a whole faced, due to the pandemic and the rapid and near-total lockdown which saw Q1 FY’20 GDP shrink by over 25%),” he said.

Even this legal provision for compensation has been subject to multiple “interpretations”, each one at the expense of the States, and that the final “solution” has been arrived at after contentious debates about the “actual intent” of an integral component of the law. On the other hand, the structural costs to the States, in terms of loss of control and fiscal autonomy, have turned out to be larger than feared at inception, often driven by operational and executional deficiencies and flaws, Mr Rajan said.

Taken together, the actual costs have been much higher than the actual benefits, he said and reiterated that “a fundamental rethinking of the entire model of taxation, leading to a complete overhaul of both Direct and Indirect Taxes, is the need of the hour,” he said.

Drawing the Council’s attention to a couple of long-standing issues, he said the burden of GST compliance has fallen disproportionately on small taxpayers in terms of both complexity and technology. His interaction with GST taxpayers, particularly small traders, revealed that they faced difficulty in using their user accounts in the GSTN portal because of language problems. As all the content is only in English, they are compelled to avail of the services of “tax consultants”, which increases their cost of compliance while simultaneously denying them complete control over filing of their tax returns, he pointed out.

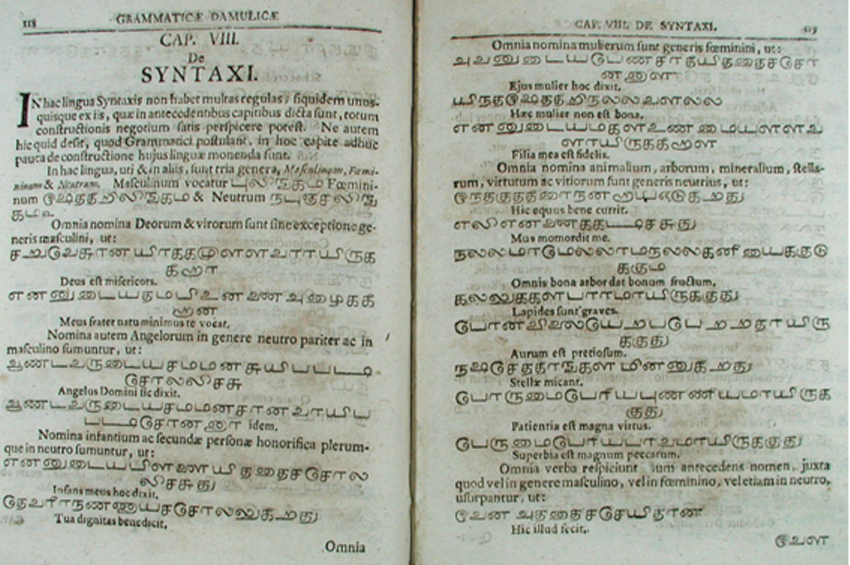

“Tamil Nadu is a business-friendly State, which wants to provide a supportive environment for both large businesses and small businesses,” he said, adding, in the four years since the inception of GST, no substantive efforts have been undertaken with respect to the provision of services in Tamil.

“Our government has given an assurance in the legislative assembly that it will arrange to provide GST-related services in Tamil. Therefore, we urge the august Council to direct GSTN to provide services in Tamil as quickly as possible. We have already offered our assistance to the GSTN in translating the forms and content of the web portal. We look forward to an immediate positive response from GSTN in this regard,” he said.

On the contentious issue of bringing petrol and diesel prices under the ambit of GST, Mr Rajan said the Tamil Nadu government was of the general opinion that State Taxation of petrol and diesel remains one of the last vestiges of any State’s right to manage their own revenues, since the advent of GST stripped away most of the small range of rights originally written into the Constitution.

PETROL, DIESEL SHOULD BE OFF GST FOR NOW

“As such we are reluctant to give up any of these few remaining rights, and so are fundamentally opposed to bringing these products into the ambit of GST. Our concerns are increased manifold by Union Government raising its taxation on petrol and diesel between 500 per cent and 1,000 per cent between 2014 and today,” he said.

Mr Rajan further pointed out that Union Government simultaneously changed the mix of this taxation from over 90 per cent Excise (shareable to the States under Finance Commission formulae) and less than 10 per cent cess and surcharge (not shared to the States) in 2014, to only about 4 per cent of the total Union taxation of these products remaining in the form of Excise today, while a whopping 96 per cent of the taxation has been switched to cess and surcharge of which not even one paisa was shared to the States

These developments have deprived the States of huge amounts of Revenue, while increasing the Union government’s revenues from the products by Trillions of Rupees (Lakhs of Crores) annually. “Under these circumstances, we feel it would be a grave, potentially fatal, injustice to shift State Taxation of Petrol & Diesel away from levels determined solely by each state, to the ambit of GST,” Mr Rajan said in no uncertain terms.

However, if and when the Union were to completely drop the levy of all cess and surcharge on petrol and diesel, the State government would be happy to reconsider its position at such a time. This cannot be examined in isolation, without examining the overall resource distribution between Union and States and devising the means to restore the fiscal autonomy of the States, he made it clear.

Mr Rajan also strongly opposed the proposal to levy a higher rate of 18 per cent on job work services provided by contract manufacturers to the brand owners for the manufacture of alcoholic liquor for human consumption. Tamil Nadu has consistently

opposed the levy at a higher rate, he said. States have a right to levy tax on alcoholic liquor for human consumption and the proposed increase would curtail the fiscal room available to States to vary the tax on alcoholic liquor for augmentation of revenue.

SKEWED RATES ON COCONUT OIL ANTISOUTH

Tamil Nadu also vehemently opposed to the recommendation of the Fitment Committee to levy 18 per cent GST on Coconut oil packed and sold in a unit container of less than 1,000 ml, classifying it as Hair oil and 5 per cent GST when the same oil is packed and sold in a unit container of 1,000 ml or above, classifying it as edible oil.

“We find this recommendation to be perverse and lacking in either logic or fairness. This is antipoor (who buy oil in small quantities), anti-southern states (where the bulk of coconuts are grown), and anti-Indian (giving preference to oils like Olive & The GST Council has nominated Tamil Nadu future,” he said. Finance Minister PTR Palanivel Thiaga Rajan in the Group of Ministers (GoM) formed to usher in GST system reforms. “Happy to be nominated as a member of the GST Council standing GoM on system reforms” Mr Rajan tweeted on September 26 with a symbolic Namaste to Union Finance Minister Nirmala Sitharaman and the GST Council. He said Chief Minister M.K Stalin has asked him and Commercial Taxes Minister P Moorthy to work on reforms concerning Tamil Nadu. “Looking forward to now working with friends & colleagues to improve the process for all of India,” Mr Rajan further said in his tweet. The GoM of GST System Reforms will review the IT tools and interface available with tax officers and suggest measures to make the system more effective and efficient, including changes in business processes. It would also identify potential sources of evasion and suggest changes in business processes and IT systems to plug revenue leakage. Palm, which are imported from other countries),” Mr Rajan said. Lakhs of coconut farmers of Tamil Nadu and the other southern states would neither forget nor forgive this gross injustice against them, he said.

EXPLAINS ABSENCE FROM GST MEET

Mr. Thiaga Rajan has said he could not attend the GST Council meeting in person due to unavoidable commitments in his Constituency made prior to the receipt of the invitation intimating the date of the meeting, as well as the backlog of events accrued over the many weeks preceding the recently concluded Budget Session of the Tamil Nadu Legislative Assembly. “While I am disappointed to lose this opportunity to meet the illustrious members from other States in person, I hope the next occasion will not be very far in the future,” he said.